zprávy

zdroje zpráv:Odborný referent/vrchní referent v oddělení dokumentace KN na Katastrálním pracovišti Znojmo

21.12.2021 11:31 ČÚZK /Urady/Katastralni-urady/Katastralni-urady/Katastralni-urad-pro-Jihomoravsky-kraj/Uredni-deska/Oznameni-a-jina-uredni-sdeleni/Volna-mista/DMS/Odborny-referent-vrchni-referent-v-oddeleni-dokumeOdborný referent/vrchní referent v oddělení dokumentace KN na Katastrálním pracovišti Znojmo

21.12.2021 11:31 ČÚZK - volná místa Katastrální úřad pro Jihomoravský kraj Katastrální pracoviště Znojmo vypisuje výběrové řízení na místo Odborný referent/vrchní referent v oddělení dokumentace KN na Katastrálním pracovišti ZnojmoRada/odborný rada v oddělení aktualizace PI KN č.2 na Katastrálním pracovišti Brno - venkov

21.12.2021 11:25 ČÚZK - volná místa Katastrální úřad pro Jihomoravský kraj Katastrální pracoviště Brno-venkov vypisuje výběrové řízení na místo Rada/odborný rada v oddělení aktualizace PI KN č.2 na Katastrálním pracovišti Brno - venkovRada/odborný rada v oddělení aktualizace PI KN č.2 na Katastrálním pracovišti Brno - venkov

21.12.2021 11:25 ČÚZK - předpisy a opatření Katastrální úřad pro Jihomoravský kraj Katastrální pracoviště Brno-venkovvypisuje výběrové řízení na místo

Rada/odborný rada v oddělení aktualizace PI KN č.2 na Katastrálním pracovišti Brno - venkov

Rada/odborný rada v oddělení aktualizace PI KN č.2 na Katastrálním pracovišti Brno - venkov

21.12.2021 11:25 ČÚZK /Urady/Katastralni-urady/Katastralni-urady/Katastralni-urad-pro-Jihomoravsky-kraj/Uredni-deska/Oznameni-a-jina-uredni-sdeleni/Volna-mista/DMS/Rada-odborny-rada-v-oddeleni-aktualizace-PI-KN-c-2INFORMACE K PLATBÁM V HOTOVOSTI V ZÁVĚRU ROKU

21.12.2021 9:54 ČÚZK - předpisy a opatření Katastrální úřad pro Olomoucký kraj - Katastrální pracoviště Šumperk zveřejnil novou aktualitu: Dovolujeme si upozornit, že ve dnech 28., 29., 30. a 31. 12. 2021 nebude možná úhrada správních poplatků v hotovosti.Správní poplatek bude možné uhradit platební kartou nebo bezhotovostním převodem, příp. kolkovou známkou zakoupenou u prodejců cenin. V těchto dnech nebude možné zřídit službu sledování změn.

Děkujeme za pochopení a přejeme klientům příjemné prožití

vánočních svátků a do nového roku hodně zdraví.

Ing. Daniel Janošík

ředitel

Katastrálního úřadu pro Olomoucký kraj

INFORMACE K PLATBÁM V HOTOVOSTI V ZÁVĚRU ROKU

21.12.2021 9:54 ČÚZK /Urady/Katastralni-urady/Katastralni-urady/Katastralni-urad-pro-Olomoucky-kraj/Katastralni-pracoviste/KP-Sumperk/O-uradu/Aktuality/INFORMACE-K-PLATBAM-V-HOTOVOSTI-V-ZAVERU-ROKUPowerDraft ukončen (1.12.2021)

21.12.2021 9:41 GISoftFirma Bentley oznámila ukončení vývoje produktu MicroStation PowerDraft. Produkt je stažen z prodejních nabídek a již ho není možné zakoupit. Stavající uživatelé s uzavřenou smlouvou Bentley SELECT mají možnost přechodu na MicroStation (vyšší poplatky Bentley SELECT a možnost aktualizací MicroStationu) nebo zachování stávající verze (bez možnosti aktualizací a podpory produktu PowerDraft).

PowerDraft ukončen (1.12.2021)

21.12.2021 9:41 GISoftFirma Bentley oznámila ukončení vývoje produktu MicroStation PowerDraft (ukončen vývoj, již se nedodává). Produkt je stažen z prodejních nabídek a již ho není možné zakoupit. Stavající uživatelé s uzavřenou smlouvou Bentley SELECT mají možnost přechodu na MicroStation (vyšší poplatky Bentley SELECT a možnost aktualizací MicroStationu) nebo zachování stávající verze (bez možnosti aktualizací a podpory produktu PowerDraft).

PowerDraft ukon�en (1.12.2021)

21.12.2021 9:41 GISoftFirma Bentley ozn�mila ukon�en� v�voje produktu MicroStation PowerDraft (ukon�en v�voj, ji� se nedod�v�). Produkt je sta�en z prodejn�ch nab�dek a ji� ho nen� mo�n� zakoupit. Stavaj�c� u�ivatel� s uzav�enou smlouvou Bentley SELECT maj� mo�nost p�echodu na MicroStation (vy��� poplatky Bentley SELECT a mo�nost aktualizac� MicroStationu) nebo zachov�n� st�vaj�c� verze (bez mo�nosti aktualizac� a podpory produktu PowerDraft).

PowerDraft ukon�en (1.12.2021)

21.12.2021 9:41 GISoftFirma Bentley ozn�mila ukon�en� v�voje produktu MicroStation PowerDraft (ukon�en v�voj, ji� se nedod�v�). Produkt je sta�en z prodejn�ch nab�dek a ji� ho nen� mo�n� zakoupit. Stavaj�c� u�ivatel� s uzav�enou smlouvou Bentley SELECT maj� mo�nost p�echodu na MicroStation (vy��� poplatky Bentley SELECT a mo�nost aktualizac� MicroStationu) nebo zachov�n� st�vaj�c� verze (bez mo�nosti aktualizac� a podpory produktu PowerDraft).

Státní pozemkový úřad spustil vlastní geografický portál

21.12.2021 0:00 Státní pozemkový úřad Praha, 21. prosince 2021 – Státní pozemkový úřad (SPÚ) spouští pro veřejnost vlastní geografický portál. V rámci tohoto veřejného informačního systému budou uživatelům poskytovány aktuální a přehledné geografické informace vztažené k agendám SPÚ.ISPRS e-bulletin: 2021 – Issue No.5

20.12.2021 23:06 Společnost pro fotogrammetrii a dálkový průzkumISPRS e-bulletin: 2021 – Issue No.5

The post ISPRS e-bulletin: 2021 – Issue No.5 appeared first on SFDP.

ISPRS e-bulletin: 2021 – Issue No.5

20.12.2021 23:06 Společnost pro fotogrammetrii a dálkový průzkumISPRS e-bulletin: 2021 – Issue No.5

The post ISPRS e-bulletin: 2021 – Issue No.5 appeared first on SFDP.

ISPRS e-bulletin: 2021 – Issue No.5

20.12.2021 23:06 Společnost pro fotogrammetrii a dálkový průzkum ISPRS e-bulletin: 2021 – Issue No.5Česká agentura pro standardizaci koupila práva ke SNIM, standard využije k rozšíření DSS, datového standardu staveb

20.12.2021 22:23 BIM NewsČeská agentura pro standardizaci uzavřela smlouvu s Odbornou radou pro BIM – buildingSMART Česká republika (czBIM) a získala kompletní práva k datovému standardu SNIM. To otevírá cestu k dalšímu rozvoji datového standardu staveb (DSS), který se tak stane univerzálním a společným digitálním jazykem pro české stavby. Česká agentura pro standardizaci a Odborná rada pro BIM […]

The post Česká agentura pro standardizaci koupila práva ke SNIM, standard využije k rozšíření DSS, datového standardu staveb appeared first on BIM News.

GIS-Pro 2022: 60th Annual Conference will be held in Boise, Idaho

20.12.2021 22:05 GISCafe.com Webcasts-Webinars URISA is pleased to announce its 60th anniversary conference, GIS-Pro 2022, taking place October 3-6, 2022 in Boise, Idaho. The international …Intermap Wins Prime Contract from the U.S. Air Force

20.12.2021 16:48 GISCafe.com Webcasts-Webinars DENVER, Dec. 20, 2021 — (PRNewswire) — Intermap Technologies (TSX: IMP) (OTCQX: ITMSF) ("Intermap" or the "Company"), a global leader in …odborný referent - zápisy v řízení V a Z v oddělení právních vztahů k nemovitostem Katastrálního pra

20.12.2021 15:09 ČÚZK - volná místa Katastrální úřad pro Jihočeský kraj Katastrální pracoviště Český Krumlov vypisuje výběrové řízení na místo odborný referent - zápisy v řízení V a Z v oddělení právních vztahů k nemovitostem Katastrálního praodborný referent - zápisy v řízení V a Z v oddělení právních vztahů k nemovitostem Katastrálního pra

20.12.2021 15:09 ČÚZK - předpisy a opatření Katastrální úřad pro Jihočeský kraj Katastrální pracoviště Český Krumlovvypisuje výběrové řízení na místo

odborný referent - zápisy v řízení V a Z v oddělení právních vztahů k nemovitostem Katastrálního pracoviště Český Krumlov (ID SM 30000156/30003780)

20211220 - VŘ Administrace systémového managementu

20.12.2021 13:55 ČÚZK /Aktuality-resort/2021/20211220-VR-Administrace-systemoveho-managementu20211220 - VŘ Administrace systémového managementu

20.12.2021 13:55 ČÚZK - předpisy a opatření Český úřad zeměměřický a katastrální zveřejnil novou aktualitu: Oznámení o vyhlášení výběrového řízení na obsazení služebního místa rada/odborný rada - Administrace systémového managementu.20211220 - VŘ Administrace systémového managementu

20.12.2021 13:55 ČÚZK - aktuality v resortu Oznámení o vyhlášení výběrového řízení na obsazení služebního místa rada/odborný rada - Administrace systémového managementu.Rada/odborný rada - Administrace systémového managementu

20.12.2021 13:48 ČÚZK - volná místa Český úřad zeměměřický a katastrální vypisuje výběrové řízení na místo Rada/odborný rada - Administrace systémového managementuRada/odborný rada - Administrace systémového managementu

20.12.2021 13:48 ČÚZK /Urady/Cesky-urad-zememericky-a-katastralni/Uredni-deska/Oznameni-a-jina-uredni-sdeleni/Volna-mista/DMS/Rada-odborny-rada-Administrace-systemoveho-managRada/odborný rada - Administrace systémového managementu

20.12.2021 13:48 ČÚZK - předpisy a opatření Český úřad zeměměřický a katastrálnívypisuje výběrové řízení na místo

Rada/odborný rada - Administrace systémového managementu

20211220_Odborný rada oddělení právních vztahů k nemovitostem

20.12.2021 11:42 ČÚZK /Urady/Katastralni-urady/Katastralni-urady/Katastralni-urad-pro-Stredocesky-kraj/Katastralni-pracoviste/KP-Benesov/O-uradu/Aktuality/20211220_Odborny-rada-oddeleni-pravnich-vztahu-k-n20211220_Odborný rada oddělení právních vztahů k nemovitostem

20.12.2021 11:42 ČÚZK - předpisy a opatření Katastrální úřad pro Středočeský kraj - Katastrální pracoviště Benešov zveřejnil novou aktualitu: Odborný rada oddělení právních vztahů k nemovitostem V části "Úřední deska", v sekci "Oznámení a jiná úřední sdělení" bylo vystaveno "Oznámení o vyhlášení výběrového řízení na obsazení služebního místa Odborný rada oddělení právních vztahů k nemovitostem"Odborný rada oddělení právních vztahů k nemovitostem

20.12.2021 11:39 ČÚZK - předpisy a opatření Katastrální úřad pro Středočeský kraj - Katastrální pracoviště Benešovvypisuje výběrové řízení na místo odborný rada oddělení právních vztahů k nemovitostem

Odborný rada oddělení právních vztahů k nemovitostem

Referent/ka zeměměřictví a katastru nemovitostí

20.12.2021 11:38 ČÚZK /Urady/Zememericky-urad/Volna-mista/Referent-ka-zememerictvi-a-katastru-nemovitostiReferent/ka zeměměřictví a katastru nemovitostí

20.12.2021 11:38 ČÚZK - volná místa Zeměměřický úřad vypisuje výběrové řízení na místo Referent/ka zeměměřictví a katastru nemovitostíReferent/ka zeměměřictví a katastru nemovitostí

20.12.2021 11:38 Zeměměřický úřad Zeměměřický úřadvypisuje výběrové řízení na místo

Referent/ka zeměměřictví a katastru nemovitostí

Referent/ka zeměměřictví a katastru nemovitostí

20.12.2021 11:38 ČÚZK - předpisy a opatření Zeměměřický úřadvypisuje výběrové řízení na místo

Referent/ka zeměměřictví a katastru nemovitostí

20211220_Odborný referent oddělení dokumentace katastru nemovitostí

20.12.2021 11:33 ČÚZK - předpisy a opatření Katastrální úřad pro Středočeský kraj - Katastrální pracoviště Rakovník Vyhlášení výběrového řízení: Odborný referent oddělení dokumentace katastru nemovitostí V části "Úřední deska", v sekci "Oznámení a jiná úřední sdělení" bylo vystaveno "Oznámení o vyhlášení výběrového řízení na obsazení služebního místa Odborný referent oddělení dokumentace katastru nemovitostí"20211220_Odborný referent oddělení dokumentace katastru nemovitostí

20.12.2021 11:33 ČÚZK /Urady/Katastralni-urady/Katastralni-urady/Katastralni-urad-pro-Stredocesky-kraj/Katastralni-pracoviste/KP-Rakovnik/O-uradu/Aktuality/20211220_Odborny-referent-oddeleni-dokumentace-katOdborný referent oddělení dokumentace katastru nemovitostí

20.12.2021 11:28 ČÚZK - předpisy a opatření Katastrální úřad pro Středočeský kraj - Katastrální pracoviště Rakovníkvypisuje výběrové řízení na místo odborný referent oddělení dokumentace katastru nemovitostí

Odborný referent oddělení dokumentace katastru nemovitostí

Odborný referent oddělení dokumentace katastru nemovitostí

20.12.2021 11:28 ČÚZK - volná místa Katastrální úřad pro Středočeský kraj - Katastrální pracoviště Rakovník vypisuje výběrové řízení na místo Odborný referent oddělení dokumentace katastru nemovitostívýběrové řízení na KP Havlíčkův Brod

20.12.2021 10:58 ČÚZK - předpisy a opatření Katastrální úřad pro Vysočinu - Katastrální pracoviště Havlíčkův Brod zveřejnil novou aktualitu: Oznámení o vyhlášení výběrového řízení na služební místo odborný referent v oddělení aktualizace KN I Katastrálního pracoviště Havlíčkův Brod.odborný referent_aktualizace KN I_KP Havlíčkův Brod

20.12.2021 10:23 ČÚZK /Urady/Katastralni-urady/Katastralni-urady/Katastralni-urad-pro-Vysocinu/Uredni-deska/Oznameni-a-jina-uredni-sdeleni/Volna-mista/DMS/odborny-referent_aktualizace-KN-I_KP-Havlickuv-Broodborný referent_aktualizace KN I_KP Havlíčkův Brod

20.12.2021 10:23 ČÚZK - předpisy a opatření Katastrální úřad pro Vysočinu Katastrální pracoviště Havlíčkův Brodvypisuje výběrové řízení na místo

odborný referent_aktualizace KN I_KP Havlíčkův Brod

odborný referent_aktualizace KN I_KP Havlíčkův Brod

20.12.2021 10:23 ČÚZK - volná místa Katastrální úřad pro Vysočinu Katastrální pracoviště Havlíčkův Brod vypisuje výběrové řízení na místo odborný referent_aktualizace KN I_KP Havlíčkův BrodVymeňte starú kontrolnú jednotku za novú

20.12.2021 9:41 Geotronics.sk MODERNIZUJTE GNSS ZOSTAVU Vymeňte starú kontrolnú jednotku za novú Trimble TDC600 3 219 € bez DPH 2 700 € bez DPH Trimble TSC5 5 003 € bez DPH 4 400 € bez DPH Ako prebieha výmena? 1. [...]Vymeňte starú kontrolnú jednotku za novú

20.12.2021 9:41 Geotronics.sk MODERNIZUJTE GNSS ZOSTAVU Vymeňte starú kontrolnú jednotku za novú Trimble TDC600 3 219 € bez DPH 2 700 € bez DPH Trimble TSC5 5 003 € bez DPH 4 400 € bez DPH Aké výhody mi prinesie nová [...]Dedrone Secures $30.5 Million Series C to Protect Airspace Against Unauthorized Drones

20.12.2021 9:00 GISCafe.com Webcasts-Webinars Axon leads investment round to help ensure airspace security and community safetySAN FRANCISCO — (BUSINESS WIRE) — December 17, 2021 …

Upozornění - platby

20.12.2021 8:36 ČÚZK - předpisy a opatření Katastrální úřad pro Vysočinu - Katastrální pracoviště Havlíčkův Brod zveřejnil novou aktualitu: UPOZORNĚNÍVážení klienti, z technických důvodů v období od 30. 12. 2021 do 31. 12. 2021 nepřijímáme platby v hotovosti. Správní poplatky lze uhradit:platební kartou, bezhotovostním převodem, kolkovou známkou.

Děkujeme za pochopení

Upozornění - platby

20.12.2021 8:36 ČÚZK /Urady/Katastralni-urady/Katastralni-urady/Katastralni-urad-pro-Vysocinu/Katastralni-pracoviste/KP-Havlickuv-Brod/O-uradu/Aktuality/Upozorneni-platbyUkončení provozu nástroje Eshop

20.12.2021 8:23 CENIA - národní geoportál INSPIRE Vážení uživatelé Národní geoportálu INSPIRE, tímto Vám oznamujeme, že Od 1. 1. 2022 bude na Národním Geoportálu INSPIRE ukončen provoz nástroje Eshop. Děkujeme za pochopení.SatLab shone in GeoSmart India 2021

20.12.2021 3:22 Satlab GeosolutionsDuring the 7th-9th of December 2021, the GeoSmart India 2021 was successfully held in Hyderabad, India. It is a platform for high-level networking, knowledge sharing, and capacity building, which also provides an opportunity to enhance business reach. Our local dealer Elkay Electromech India attended this annual event on behalf of SatLab and we are proud […]

The post SatLab shone in GeoSmart India 2021 appeared first on SatLab – Global Satellite Positioning Solutions.

SatLab Shone in GeoSmart India 2021

20.12.2021 3:22 Satlab GeosolutionsDuring the 7th-9th of December 2021, the GeoSmart India 2021 was successfully held in Hyderabad, India. It is a platform for high-level networking, knowledge sharing, and capacity building, which also provides an opportunity to enhance business reach. Our local dealer Elkay Electromech India attended this annual event on behalf of SatLab and we are proud […]

The post SatLab Shone in GeoSmart India 2021 appeared first on SatLab – Global Satellite Positioning Solutions.

pf 2022 [Knihovna geografie, byTopic]

20.12.2021 0:00 Katedra aplikované geoinformatiky a kartografie Přf UK Požehnané Vánoce a šťastný nový rok 2022 vám přeje tým Knihovny geografie :-)The Drone Racing League and Draganfly Create New STEM Program with Woz Ed and Imagine Learning's Robotify

18.12.2021 9:00 GISCafe.com Webcasts-Webinars Draganfly, DRL, WozEd and Imagine Learning's Robotify to teach thousands of students how to build, code, and fly racing drones in a new "Science of …Esri and WorldPop Partner to Bring Updated Demographic Data to Policy Makers

18.12.2021 0:56 GISCafe.com Webcasts-Webinars Annual Gridded Population Datasets Now Available through Esri's ArcGIS Living Atlas of the WorldREDLANDS, Calif. — (BUSINESS WIRE) — …

METAGEO Launches with 3D Map Platform for Bringing the Real World into the Metaverse

17.12.2021 20:07 GISCafe.com Webcasts-Webinars Powerful new map platform designed for ease of use and collaboration between desktop, mobile device, and the Metaverse

San Francisco, …

Southeast Asia’s flagship geospatial and location intelligence event to host fast-developing industry solutions

17.12.2021 19:59 GISCafe.com Webcasts-Webinars Geo Connect Asia 2022: Second edition of Southeast Asia’s flagship geospatial and location intelligence event grows to host fast-developing …Ještě jedna dávka aktualizací: verze 15.53

17.12.2021 12:21 GEPROPřipravili jsme pro vás nové verze 15.53 našich produktů, keré ocení nejen geodeti. Stahovat je můžete z obvyklého umístění na našem download serveru:

… >>20211217_odborný referent v oddělení právních vztahů k nemovitostem

17.12.2021 12:00 ČÚZK - předpisy a opatření Katastrální úřad pro Středočeský kraj - Katastrální pracoviště Benešov Vyhlášení výběrového řízení: odborný referent v oddělení právních vztahů k nemovitostem V části "Úřední deska", v sekci "Oznámení a jiná úřední sdělení" bylo vystaveno "Oznámení o vyhlášení výběrového řízení na obsazení systemizovaného místa odborný referent v oddělení právních vztahů k nemovitostem"20211217_odborný referent v oddělení právních vztahů k nemovitostem

17.12.2021 12:00 ČÚZK /Urady/Katastralni-urady/Katastralni-urady/Katastralni-urad-pro-Stredocesky-kraj/Katastralni-pracoviste/KP-Benesov/O-uradu/Aktuality/20210113_odborny-rada,-reditel-Katastralniho-p-(5)odborný referent v oddělení právních vztahů k nemovitostem

17.12.2021 11:58 ČÚZK - volná místa Katastrální úřad pro Středočeský kraj - Katastrální pracoviště Benešov vypisuje výběrové řízení na místo odborný referent v oddělení právních vztahů k nemovitostemodborný referent v oddělení právních vztahů k nemovitostem

17.12.2021 11:58 ČÚZK - předpisy a opatření Katastrální úřad pro Středočeský kraj - Katastrální pracoviště Benešovvypisuje výběrové řízení na místo odborný referent v oddělení právních vztahů k nemovitostem

odborný referent v oddělení právních vztahů k nemovitostem

Earth from Space: Kourou, French Guiana

17.12.2021 10:00 ESA Observing the Earth

Ahead of the upcoming Ariane 5 launch of the James Webb Space Telescope, the Copernicus Sentinel-2 mission takes us over Kourou – home to Europe’s Spaceport in French Guiana, an overseas department of France.

Earth from Space: Kourou, French Guiana

17.12.2021 10:00 ESA Observing the Earth

Ahead of the upcoming Ariane 5 launch of the James Webb Space Telescope, the Copernicus Sentinel-2 mission takes us over Kourou – home to Europe’s Spaceport in French Guiana, an overseas department of France.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

BlackSky Achieves World’s Highest Revisit, Time-Diverse Dawn-to-Dusk Satellite Constellation with Three Successful Launches in Three Weeks

17.12.2021 9:00 GISCafe.com Webcasts-Webinars Twelve Satellite Constellation Delivers Hourly Peak Rate of 15 Revisits Per DayHERNDON, Va. — (BUSINESS WIRE) — December 13, 2021 …

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Swedish Space Corporation and SatRevolution to launch Earth Observation constellation from Esrange

17.12.2021 9:00 GISCafe.com Webcasts-Webinars Swedish Space Corporation (SSC) and the Polish space company SatRevolution have signed an agreement to launch SatRevolution's STORK Earth …Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZK

17.12.2021 9:00 ČÚZK - Geoportál Odstávka aplikací, mapových a vyhledávacích služeb Geoportálu ČÚZKDne 17.12. 2021 po 20 hodině dojde k plánované odstávce a nebudou proto dostupné funkce aplikací Geoprohlížeč, Archiv, Analýzy výškopisu. Dále nebudou dostupné mapové a vyhledávací služby publikované na URL http://ags.cuzk.cz/.

Předpokládaná doba odstávky 48 hodin. Omlouváme se za případné komplikace.

MapQuest for Business Integrates with Epic

17.12.2021 2:12 GISCafe.com Webcasts-Webinars MapQuest Business-to-Business (B2B) service has been selected to provide mapping/navigation and geolocation services for leading health information …H3 Dynamics Readies Hydrogen Propulsion for Electric Aviation, Begins Unmanned Flight Tests in France

17.12.2021 2:12 GISCafe.com Webcasts-Webinars TOULOUSE, France, Dec. 15, 2021 — (PRNewswire) — H3 Dynamics' Toulouse team have completed wind tunnel tests of a long-range …Ouster to Showcase DF and OS Series Digital Lidar at CES Las Vegas 2022

17.12.2021 2:12 GISCafe.com Webcasts-Webinars Ouster management, customers, and partners to exhibit autonomy solutions for automotive, industrial, smart infrastructure, and robotics applications …Hesai Pandar128 Ground Truth LiDAR Supported on NVIDIA DRIVE Autonomous Vehicle Platform

16.12.2021 18:21 GISCafe.com Webcasts-Webinars SHANGHAI, Dec. 16, 2021 — (PRNewswire) — Hesai Technology Co., Ltd., a global leader in 3D LiDAR sensors, today announced that its …National Geospatial-Intelligence Agency Awards Orbital Insight with Phase II SBIR Contract

16.12.2021 18:21 GISCafe.com Webcasts-Webinars Geospatial intelligence company will partner with Rendered.ai and the University of California, Berkeley to deliver a first-of-its-kind computer …Panzura Speeds Up Cloud Data Move With New Panzura Managed Migrations

16.12.2021 18:21 GISCafe.com Webcasts-Webinars Panzura Delivers Full-Service, Lightning-Fast Data Migration From Zero to Done With Dedicated Experts and Blue-Sky Thinking to Complete Any NAS or …Hexagon's R-evolution expands its sustainability agenda to help protect coastal blue carbon ecosystems

16.12.2021 18:21 GISCafe.com Webcasts-Webinars NACKA STRAND, Sweden, Dec. 16, 2021 — (PRNewswire) — Hexagon AB, a global leader in digital reality solutions, today announced …18. vánoční nadílka aplikací a bonusů od firmy Arkance Systems

16.12.2021 15:36 Arkance SystemsTradiční nadílka vánočních aplikací od Arkance Systems - dárky pro všechny uživatele CAD/CAM a BIM nástrojů

Zpráva 18. vánoční nadílka aplikací a bonusů od firmy Arkance Systems pochází z arkance-systems.cz.

YII2021 We Have Progressed a Lot in Going Digital Over the Course of the Pandemic

16.12.2021 15:32 Bentley SystemsPressCoverage

Direct Industry, France

Read the articleData Driven Decision Making for Predictable Production

16.12.2021 15:25 Bentley SystemsPressCoverage

Reliability Web, USA

Read the articleNearmap Aerial Imagery for AEC

16.12.2021 15:14 Bentley SystemsPressCoverage

AECbytes, USA

Read the articleLane Construction Constructs Storage Reservoir for Everglades Restoration

16.12.2021 15:04 Bentley SystemsPressCoverage

Civil + Structural Engineer, USA

Read the articleIts time the UK starts supporting the next generation of vehicles

16.12.2021 14:53 Bentley SystemsPressCoverage

New Civil Engineer, UK&I

Read the article20211216 - Oprava duplicit ve změnových VFR

16.12.2021 14:43 ČÚZK /ruian/Poskytovani-udaju-ISUI-RUIAN-VDP/Vymenny-format-RUIAN-(VFR)/Archiv-novinek-VFR/2021/20211216-Oprava-duplicit-ve-zmenovych-VFR20211116_Odborný rada – metodik katastru nemovitostí v oddělení metodiky a kontroly

16.12.2021 13:06 ČÚZK /Urady/Katastralni-urady/Katastralni-urady/Katastralni-urad-pro-Stredocesky-kraj/O-uradu/Aktuality/20210113_odborny-rada,-reditel-Katastralniho-(3)20211116_Odborný rada – metodik katastru nemovitostí v oddělení metodiky a kontroly

16.12.2021 13:06 ČÚZK - předpisy a opatření Katastrální úřad pro Středočeský kraj Vyhlášení výběrového řízení: Odborný rada – metodik katastru nemovitostí v oddělení metodiky a kontroly V části "Úřední deska", v sekci "Oznámení a jiná úřední sdělení" bylo vystaveno "Oznámení o vyhlášení výběrového řízení na obsazení systemizovaného místa Odborný rada – metodik katastru nemovitostí v oddělení metodiky a kontroly"Kitesurfing the white wilderness for science

16.12.2021 11:40 ESA Observing the Earth

In an astonishing feat of endurance, explorers Justin Packshaw and Jamie Facer Childs are a quarter of the way through a 3600-km kitesurf trek that takes them across the desolate heart of Antarctica. They are not pushing their physical and mental limits to the brink, facing howling gales and temperatures of –55°C just for the sake of adventure. They are gathering information to help scientists better understand how the body responds to extremes and taking unique measurements of their ice environment that will help complement ESA’s CryoSat mission to better understand how this giant ice sheet is evolving in response to climate change.

Kitesurfing the white wilderness for polar science

16.12.2021 11:40 ESA Observing the Earth

In an astonishing feat of endurance, explorers Justin Packshaw and Jamie Facer Childs are a quarter of the way through a 3600-km kitesurf trek that takes them across the desolate heart of Antarctica. They are not pushing their physical and mental limits to the brink, facing howling gales and temperatures of –55°C just for the sake of adventure. They are gathering information to help scientists better understand how the body responds to extremes and taking unique measurements of their ice environment that will help complement ESA’s CryoSat mission to better understand how this giant ice sheet is evolving in response to climate change.

Kitesurfing the white wilderness for polar science

16.12.2021 11:40 ESA Observing the Earth

In an astonishing feat of endurance, explorers Justin Packshaw and Jamie Facer Childs are a quarter of the way through a 3600-km kitesurf trek that takes them across the desolate heart of Antarctica. They are not pushing their physical and mental limits to the brink, facing howling gales and temperatures of –55°C just for the sake of adventure. They are gathering information to help scientists better understand how the body responds to extremes and taking unique measurements of their ice environment that will help complement ESA’s CryoSat mission to better understand how this giant ice sheet is evolving in response to climate change.

EASA zveřejnila NPA k U-space regulaci

16.12.2021 10:51 UAVAEASA dnes zveřejnila NPA k U-Space schválené regulaci, s podrobným návrhem AMC a GM, které vytvořila Drone expert group, v které byl i prezident UAVA. Současně je nyní možnost do 15.3.2022 dávat komentáře k tomuto NPA. NPA ke stažení zde: https://www.easa.europa.eu/newsroom-and-events/news/easa-publishes-proposal-implementation-u-space-europe

The post EASA zveřejnila NPA k U-space regulaci appeared first on UAV Aliance pro bezpilotní letecký průmysl.

Hexagon’s police records system deployed by San Angelo, Texas

16.12.2021 10:30 Hexagon Safety & InfrastructureMáme 2 nové profesory geoinformatiky – gratulujeme!

16.12.2021 5:31 GISportal.cz

Prezident republiky Miloš Zeman jmenoval ve středu dne 15. prosince 2021 na návrhy vědeckých a uměleckých rad vysokých škol nové profesorky a profesory vysokých škol. Rozhodnutí prezidenta republiky podléhá kontrasignaci předsedou vlády. Jmenovací dekrety předá ministr školství, mládeže a tělovýchovy. doc. Dr. Ing. Jiří HORÁK, pro obor: Geoinformatika na návrh Vědecké rady Vysoké školy báňské – […]

The post Máme 2 nové profesory geoinformatiky – gratulujeme! appeared first on GISportal.cz.

Maxar Reserves May 15 - June 13 Window for First WorldView Legion Launch

16.12.2021 0:24 GISCafe.com Webcasts-Webinars WESTMINSTER, Colo. — (BUSINESS WIRE) — December 15, 2021 —Maxar Technologies (NYSE:MAXR) (TSX:MAXR), provider of comprehensive …

Topcon Positioning Group expands global headquarters

16.12.2021 0:08 GISCafe.com Webcasts-Webinars LIVERMORE, Calif. – December 15, 2021 – Topcon Positioning Group has announced the opening of the new John D. Dice Training Center at its …GIS & Assessment Communities Poised to Gather in New Orleans

15.12.2021 23:51 GISCafe.com Webcasts-Webinars Des Plaines, IL (December 15, 2021) For twenty-five years, URISA and the International Association of Assessing Officers (IAAO) have …SCHNEIDER ELECTRIC ANNOUNCES LATEST RELEASE OF ARCFM DESIGNER XI

15.12.2021 23:51 GISCafe.com Webcasts-Webinars One of the most significant releases to date, ArcFM Designer 11.3.3 delivers valuable new capabilities for designers and engineersFort Collins, …

NSGIC Releases Findings from 2021 Geospatial Maturity Assessment

15.12.2021 23:43 GISCafe.com Webcasts-Webinars December 15, 2021

The National States Geographic Information Council (NSGIC) has released its 2021 comprehensive Geospatial Maturity …

Innoviz Technologies' First InnovizTwo LiDAR to be Presented at CES® 2022 According to Plan

15.12.2021 19:29 GISCafe.com Webcasts-Webinars - Innoviz announces the successful launch of the first B samples of the automotive-grade InnovizTwo LiDAR sensor.TEL AVIV, Israel, Dec. 15, 2021 …

MapQuest for Business Integrates with Epic

15.12.2021 19:29 GISCafe.com Webcasts-Webinars MapQuest Business-to-Business (B2B) service has been selected to provide mapping/navigation and geolocation services for leading health information …Lucas Emanuel Martins Proves Going Digital in Water Distribution Analysis is Ethically Responsible

15.12.2021 18:53 Bentley SystemsPressCoverage

Lucas Emanuel Martins Proves Going Digital in Water Distribution Analysis is Ethically Responsible

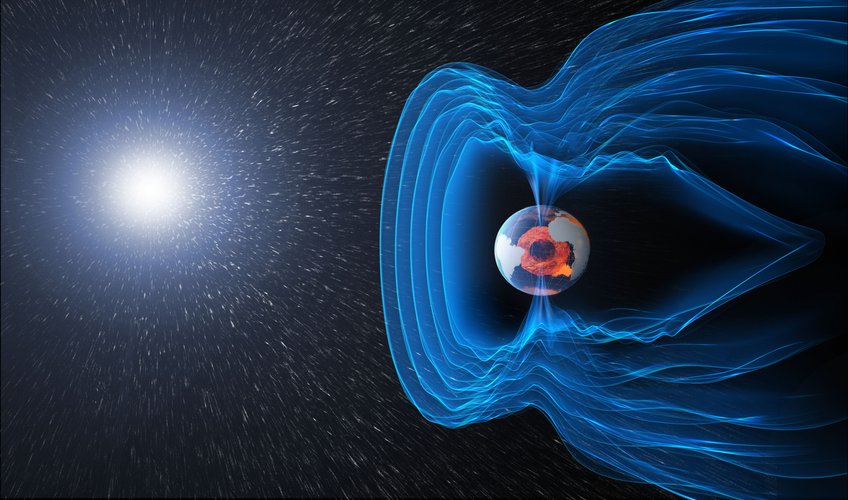

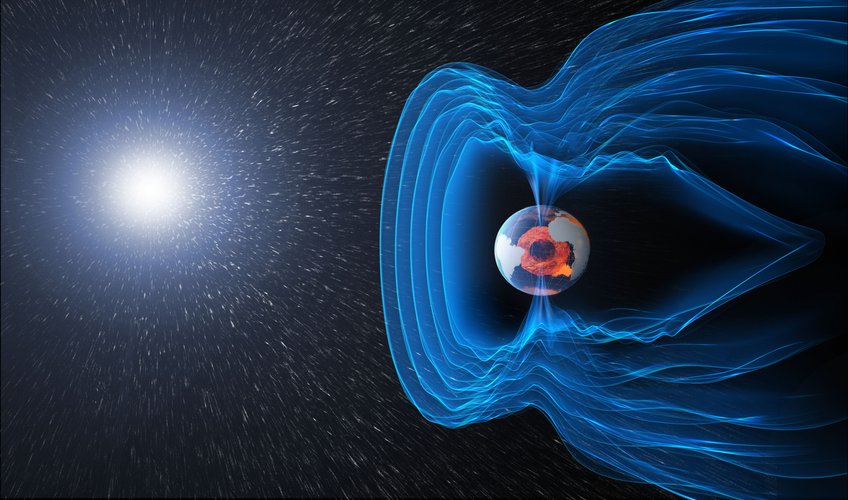

Read the articleSwarm and Cluster get to the bottom of geomagnetic storms

15.12.2021 17:10 ESA Observing the Earth

The notion of living in a bubble is usually associated with negative connotations, but all life on Earth is dependent on the safe bubble created by our magnetic field. Understanding how the field is generated, how it protects us and how it sometimes gives way to charged particles from the solar wind is not just a matter of scientific interest, but also a matter of safety. Using information from ESA’s Cluster and Swarm missions along with measurements from the ground, scientists have, for the first time, been able to confirm that curiously named bursty bulk flows are directly connected to abrupt changes in the magnetic field near Earth’s surface, which can cause damage to pipelines and electrical power lines.

Swarm and Cluster get to the bottom of geomagnetic storms

15.12.2021 17:10 ESA Observing the Earth

The notion of living in a bubble is usually associated with negative connotations, but all life on Earth is dependent on the safe bubble created by our magnetic field. Understanding how the field is generated, how it protects us and how it sometimes gives way to charged particles from the solar wind is not just a matter of scientific interest, but also a matter of safety. Using information from ESA’s Cluster and Swarm missions along with measurements from the ground, scientists have, for the first time, been able to confirm that curiously named bursty bulk flows are directly connected to abrupt changes in the magnetic field near Earth’s surface, which can cause damage to pipelines and electrical power lines.

SkyWatch Launches TerraStream Certified Solutions Provider Program to Offer End-to-End Ecosystem Support for Satellite Operators

15.12.2021 16:47 GISCafe.com Webcasts-Webinars PARIS, France, Dec. 15, 2021 (GLOBE NEWSWIRE) -- SkyWatch Space Applications Inc. ("SkyWatch"), a leading provider of machine-to-machine (M2M) …Virgin Orbit Expands Space Solutions Business With Hypersat Investment

15.12.2021 16:47 GISCafe.com Webcasts-Webinars PARIS — (BUSINESS WIRE) — December 15, 2021 —WORLD SATELLITE BUSINESS WEEK--Virgin Orbit, the responsive launch and space …

Trimble Acquires AgileAssets to Expand its Infrastructure Software Solutions Portfolio

15.12.2021 16:47 GISCafe.com Webcasts-Webinars SUNNYVALE, Calif., Dec. 15, 2021 — (PRNewswire) — Trimble (NASDAQ: TRMB) announced today it has acquired AgileAssets, a provider …Teren, Formerly SolSpec, Raises $4 Million to Address Growing ESG and Geospatial Markets

15.12.2021 16:47 GISCafe.com Webcasts-Webinars The rebrand promotes Teren's focus on 4D analytics for remotely sensed dataDENVER, Dec. 15, 2021 — (PRNewswire) — Teren, formerly …

Galileo Open Service Definition Document version 1.2 now available for download

15.12.2021 16:12 European GNSS Agency

The "Galileo - Open Service - Service Definition Document" (Galileo OS SDD) defines the Minimum Performance Levels (MPLs) of the Galileo Open Service (OS). Find out what billions of users of Galileo can expect.

The European Union Agency for the Space Programme (EUSPA) together with the European Commission announce the publication of the latest version of the Galileo Open Service Definition Document (OS SDD). The Galileo Open Service Definition Document (OS SDD) was updated on November 2021 to reflect upgrades in the Galileo system since the publication of the previous version in May 2019. The latest version, 1.2, can be found on the GSC web portal on this link.

The SDD has been updated to include improvements of the Open Service, accounting for the current constellation and updates in the ground infrastructure that increase its robustness. This is the last update foreseen before Galileo Open Service reaches Full Operational Capability (FOC).

The updated SDD provides better Minimum Performance Levels (MPLs) for signal and position availability, updated definitions of some timing MPLs, and establishes a more stringent commitment on the time to publish Notice Advisories to Galileo Users (NAGUs). In addition, the concept of auxiliary satellites has been added, while some sections have been reworded to improve clarity.

Galileo Open Service Definition Document (OS SDD) at glance

As in previous versions, the main information in the SDD includes:

- Service terms and conditions of use.

- Service characteristics (scope, general concepts, assumptions, reference systems).

- Service performance (Minimum Performance Levels and their associated conditions and constraints).

- Annexes (providing further details on the parameters, expected performance evolutions, additional metrics and the description of NAGUs).

Users are invited to download and read the updated “Galileo Open Service Definition Document (SDD)” to discover the improvements of the Open Service and learn about its main characteristics and performance. For more details on Galileo performance and its services, please contact the Galileo Help Desk. Moreover, to receive NAGUs and notifications of new Galileo publications, please register to the GSC web portal and subscribe to our newsletters.

Media note: This feature can be republished without charge provided the European Union Agency for the Space Programme (EUSPA) is acknowledged as the source at the top or the bottom of the story. You must request permission before you use any of the photographs on the site. If you republish, we would be grateful if you could link back to the EUSPA website (http://www.euspa.europa.eu).

Omezeni úředních hodin

15.12.2021 15:34 ČÚZK - předpisy a opatření Zeměměřický a katastrální inspektorát v Pardubicích zveřejnil novou aktualitu: Omezeni úředních hodin 23.12.2021 Vážení klienti,úřední hodiny na Zeměměřickém a katastrálním inspektorátu v Pardubicích budou z provozních důvodů upraveny takto:

čtvrtek 23. 12. 2021

od 8,00 h do 12,00 h

Děkujeme za pochopení.